For decades, real estate investments have been recognized as the safest, most efficient and most profitable. The real estate market is constantly growing and experiencing changes due to factors such as inflation, construction supplies, consumer preferences, among others that have modified investment models.

Today on the CREA blog we will tell you everything you need to know about the types of real estate investment. Stay to meet them!

What is real estate investment?

It is a strategy that consists of the financing, purchase or management of commercial, industrial or residential real estate assets to obtain a benefit in terms of long-term profitability.

These assets consist of vacant land, rental condominiums, corporate office buildings, commercial premises or any other real estate structure that is acquired to obtain investment returns through rental, resale or appreciation.

The acquisition of housing or real estate for personal use is also considered a real estate investment, and it is common for investors to have many properties to rent.

When investing in real estate developments there are benefits because properties are tangible assets, which provide a feeling of stability and security, since their value increases with time and capital gains. Additionally, they offer regular income, providing a flow of capital to earn profits or refinance to reinvest in other properties.

In the long term, investors can sell their properties at higher prices than they bought them for, generating significant profits.

Types of real estate investment

There are different investment strategies, such as funds, property purchases, crowdfunding, trusts, among others, which we will delve into below:

Fixed income investments

Fixed income is an investment approach focused on preserving capital and maintaining a steady stream of income, with less risk than stocks. Although the potential profitability of these products is lower, they carry less risk and allow you to obtain fixed interest from their issuance to their maturity.

Examples of fixed income investments are mortgage-backed bonds, real estate corporate bonds, commercial or residential real estate, government bonds, CETES, stocks, investment funds, trusts or real estate fibers.

Variable income investments

Variable income is an investment instrument that is characterized by not having a potential for future returns since they are operations that depend on factors such as the stock market or business actions. Their advantage is that they provide a higher return compared to fixed income.

Equity investments can be similar to fixed income investments, for example, mortgage-backed bonds, stocks, corporate bonds of real estate companies, commercial and residential real estate, among others.

Investment funds

Investment funds are savings instruments in which collective assets are brought together, among which there may be financial instruments such as shares, fixed-income, variable or hybrid securities. These funds work by bringing together a group of participants who contribute significant capital that will be managed by specialists.

One of the benefits of investment funds is that they have large capital, so they do not usually focus on a single type of property, but rather on commercial, residential or industrial properties.

Real estate crowdfunding

Crowdfunding is a collective financing model for a group of investors to finance projects through digital platforms. It is a system used by small investors who are starting to invest in real estate, or by investors who have little capital.

This collection method generates profits in the medium and long term, with advantages such as diversification of the client portfolio and access to lower-ranking investors.

Properties in pre-sale

One of the best options to invest is to acquire properties that are still in the process of construction, in which developers and construction companies seek to attract the greatest number of clients to finance themselves and move forward.

For buyers, the main benefit is to buy properties at a lower price and that, over time, will gain value due to the capital gain. For construction companies, pre-sale systems offer financing systems that allow projects to be sold in stages.

Remodeling and sale

The model known as House Flipping consists of acquiring properties at a low cost to remodel and recondition them and sell them at a higher price. In the case of new homes, investors acquire properties with few finishes to adapt them, expand them and give them finishes that significantly increase their value.

This model is widely used by investors with experience in decoration and construction to generate large profits.

Investment in vacant land

It consists of the purchase of land that does not have any construction to carry out various real estate projects, such as houses, residential or commercial buildings, shopping plazas, parking lots, among other options supported by market analysis to obtain the highest profitability.

Acquisition and rental of real estate

Acquiring properties in strategic locations provides the opportunity to rent them for different uses:

- Tourist income. This model is one of the most recognized in real estate investment, it consists of adapting a property for vacation rentals for short periods, Airbnb style, or with other options such as hotel rentals with luxury services such as restaurants, bars or jacuzzis. In general, tourist rentals allow for a high return on investment because you can charge more for the amenities that the property has.

- Residential income. This model is traditional in which a property is rented for the tenant to live in for a specific period.

- Rentals of commercial premises. Investment in commercial premises generates great income returns and they are spaces that increase their value thanks to the capital gains.

Residential real estate properties

It consists of investing in residential areas, such as subdivisions or real estate developments where properties such as homes, multi-family homes, condominiums, among others, are sold. These areas not only provide profits from the sale of the property, but also from maintenance, condominium management, security and other amenities.

Commercial Real Estate

It consists of investing in plazas or shopping centers to rent premises to wholesale stores, retailers, offices, hotels, among other businesses. It is a more complex and expensive investment, and at the same time, it offers greater profitability than residential investment.

Industrial real estate properties

It consists of investment in industrial zones such as warehouses, warehouses, factories, storage centers, among others that generate income by leasing the facilities.

Multi-use real estate properties

Mixed-use properties combine several types of properties into a single project. They are high, complex investments that generate excellent returns due to the diversity of clients to whom the developments are directed.

Investment strategies for real estate development

There are many investment strategies in real estate developments that generate profits in the short, medium and long term. The best known are:

Rent

Renting property is a quick, direct and safe way to generate income. The key is to find responsible tenants who generate a fixed monthly income to receive profits and invest in other properties.

Real estate investment trusts

It is a strategy to share financial responsibility, which allows you to have shares in real estate without completely owning it, generating profits from the sale or rental of the properties.

Wholesales

It is an option that allows for short-term profitability. It consists of searching for properties for sale, acquiring them and reselling them or transferring them for a higher cost.

Online investment platforms

Some fundraising companies have online platforms for real estate developers to apply for financing for projects, allowing individual investors to purchase stocks or bonds.

Investing in foreclosures

It is a strategy in which investors acquire properties at auction or auction. They are profitable investments, which allow for medium and long-term benefits when reselling or renting the property.

What is real estate investment advisory?

Real estate investment advice consists of guiding investors throughout the entire process: before, during and after investing in a real estate project. In general, advisors know the market, the price range in different places, the areas with the highest capital gains, in addition to carrying out market analysis to support their recommendations.

On the other hand, real estate investment advice is personalized, which requires analysis of the investor profile, market studies, feasibility analysis, among other studies to detect the most profitable investment opportunities.

What are the essential functions of a real estate investment advisor?

Some of the functions of real estate investment advisors are:

- Detect investment opportunities adapted to the characteristics of the investor

- Perform financial analysis

- Create a link between the investor and the property

- Review of contracts and purchase and sale processes

- Identify risks and possible scams

- Valuation and appraisal of real estate

- Development of marketing plans

Benefits of consulting for investment companies in real estate developments

Turning to real estate advisors can bring the following benefits:

- Identify profitable and safe investment opportunities

- Optimize operating and service costs

- More successful sales closings

- Create innovation strategies

- Achieve the objectives set before the investment

- Better understanding of the market, customers and opportunities

- Know the competition and their strategies to be successful

- Make decisions with financial and legal support

- Flexible payment schemes

- Have guidance for future investments, renovations or changes in the property portfolio

Factors to consider: evaluating the profitability of real estate developments

Evaluating the profitability of a real estate development requires taking into account various measurable factors that reduce risks. These factors are:

Legal and regulatory framework for real estate investments

Before investing in a real estate development, it is essential to know and understand the legal and regulatory framework of the property: zoning laws, land use rules, environmental restrictions, taxes, building standards, among others that influence profitability and viability. of the property.

For this, resorting to real estate advisors or consultants is essential since many of them work in collaboration with real estate lawyers who guarantee compliance with the laws and minimize risks.

Case studies

The analysis of similar real estate developments in the geographic area where the project is located provides information on the possible profitability and challenges that the investor could face. It also allows you to know how previous problems have been resolved to anticipate possible obstacles and create better strategies for the development in question.

Feasibility studies

To analyze financial profitability, financial viability studies, projection of acquisition costs, development, construction, financing analysis, taxes, projections of expected income from the sale or rental of properties, cash flows, internal rate must be considered. return, net present value, among other financial indicators to determine how profitable the project is.

Why is real estate investment advice necessary?

Turning to a real estate advisor is key to making an intelligent investment, choosing properties in strategic locations, good projections in capital gains and profitability, with fewer risks during the process.

Real estate investment advice is key to saving time, having feasibility studies carried out by professionals, having the best offers and investment opportunities, complying with legal regulations, negotiating fair contracts, streamlining mortgage procedures and having the desired profitability.

How is a market study done for real estate investment?

Market studies are carried out with socioeconomic data, demand data, real estate data, among other important data to determine the market value of the property. With this, the investor will be able to have a clearer idea of the competitiveness and profitability of the property.

Why invest in the real estate sector in Mexico?

Investing in real estate comes with potential risks, extensive research, and a lot of money. However, these investments bring with them many advantages that determine their profitability; For example:

- Constant cash flow

- Excellent return on investment

- High level of capital gains

- Safe long-term investments

- Tax benefits associated with deducting property expenses

- Diversification of the client portfolio

- Continuous and growing passive income

- Inflation protection

- Possibility of accumulating capital to reinvest

Where to invest in real estate in Mexico for housing development

According to Loft, the cities with the greatest appeal for homeownership due to their infrastructure and safety include:

- Pachuca

- Aguascalientes

- Ciudad de México

- Querétaro

- Guadalajara

- Monterrey

- Mérida

For its part, Inmobiliare includes cities like Puerto Vallarta, due to their potential for residential properties for vacation rentals.

Where to invest in industrial real estate?

A trigger for Foreign Direct Investment in industrial real estate developments is nearshoring.

In 2024, the industrial real estate sector had an occupancy rate of 96%. (Mexico Industrial Market Report 2024)

On the other hand, the Mexican Association of Industrial Parks estimates that our country will receive an investment of around US$6.14 billion from real estate developers.

Three factors are recommended when choosing an industrial space:

1) proximity to ports or key routes;

2) proximity to companies in the same sector and cutting-edge spaces where other businesses optimize processes.

Among the best states for investing in industrial and nearshoring real estate are:

- Nuevo León

- Baja California

- Querétaro

- Jalisco

- Ciudad de México y Estado de México

- Guanajuato

- Yucatán

- Chihuahua

Where to invest in real estate in Mexico for the tourism and vacation rental sectors?

The real estate segment for tourism and vacation accommodations is yielding large profits for those who invest in it, since the Mexican Association of Tourism Developers (Amdetur) estimates that by the end of 2025 the vacation property segment will grow 6% compared to 2024, supported by favorable economic conditions, geographic diversification of development, and solid international demand.

The value of vacation destinations continues to increase by 2025, as is the case in Puerto Vallarta with an estimated 18% increase, Los Cabos with 17%, and Tulum with 14% annually. (What are the Top 5 cities in Mexico with the highest real estate value in 2025? – Coldwell Banker Mexico – Coldwell Banker)

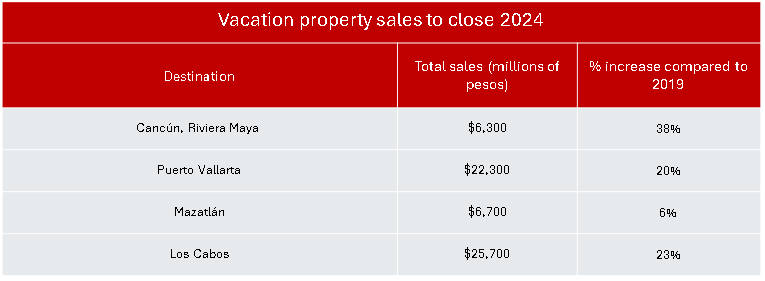

According to the Mexican Association of Tourism Developers (AMDETUR), the top four destinations for vacation property sales are Cancún – Riviera Maya, with a 38% increase compared to 2019 sales, Puerto Vallarta with a 20% increase, Mazatlán with a 6% increase, and Los Cabos with a 23% increase.

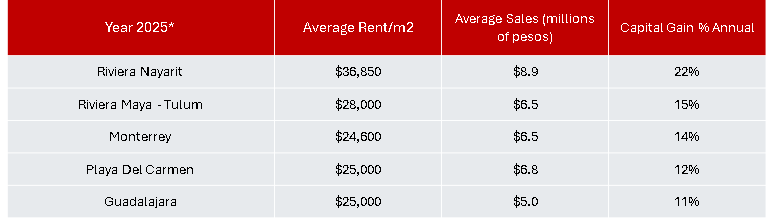

According to the economist, data from Inmuebles 24 shows the destinations with the greatest added value by the second half of 2025.

Trust CREA Solutions for the success of your investment

At CREA Soluciones we offer a real estate consulting services that will facilitate the success of your investment and make it more profitable. We have feasibility study services, real estate repositioning, highest and best use real estate, appraisals, custom studies, among others that will help you achieve success in your investment.

Request more information about real estate valuation service and mixed-use development through the contact form, email info@creasoluciones.com.mx or call us at 5552778044. A specialist will be happy to assist you.