Mexicali stands out as a vital economic center in northern Mexico, thanks to its location bordering the United States. With two main border crossings: Puerto Fronterizo Mexicali I and Puerto Fronterizo Mexicali II, Mexicali attracts significant investment and experiences dynamic economic growth. Currently, real estate market studies have detected a wide preference for this city among investors and among those who seek to establish themselves in the state of Baja California, due to the advantages it offers to establish new businesses and develop various productive projects.

Investment & Economic Development

In the second quarter of 2023, Baja California ranked third nationally in Foreign Direct Investment (FDI) with $1,463.3 million dollars, representing 5% of the national total. The United States (US$665M), Japan (US$492M) and the Netherlands (US$93.7M) were the main source countries of FDI in the region. In addition, Mexicali is part of the Total Nearshoring Solution Program, promoting investment in sectors such as the electronics, medical device and aerospace industries.

At the end of Q2 2023, the municipality of Mexicali ranked second in the receipt of remittances with $145.5 million, representing 20.4% of the entity.3

Industry

Mexicali is immersed in the Total Nearshoring Solution Program, an initiative promoted by the Business Coordinating Council to turn it into a center of attraction for investments. As part of this growth strategy, DEITAC has managed to attract significant investment in the last year, with an impressive $635 million earmarked for land and construction of industrial warehouses. This investment not only represents a significant economic injection for the region, but also leads to the creation of between 15 and 20 thousand direct and indirect jobs.

The electronics industry plays a crucial role in this transformation, with 180 manufacturing plants that have generated more than 120,000 jobs in Mexicali. In addition, the medical device sector has attracted talent and contributed to the development of biotechnology, bioengineering, aquaculture, and marine sciences.

In the aerospace field, Baja California represents 21 percent of the national sector, in this sense it covers key segments such as commercial, defense, space, cargo and logistics, as well as the manufacture of drones and the development of maintenance and repair instruments.

As of February 2023, the Mexican Association of Industrial Parks (AMPIP) has registered a total of 27 industrial parks in the region, showcasing Mexicali’s growing attractiveness as a destination for industry. With these initiatives and the support of key organizations, this city is consolidating itself as a strategic economic hub in northern Mexico, offering investment and growth opportunities for national and international companies alike. At this key moment for the region, real estate market studies will be able to detect the specific interests and needs of new investors, in order to strengthen the supply of spaces.

Demography

In 2020, the population of Mexicali reached 1,049,792 inhabitants, distributed in 50.4% men and 49.6% women. This figure represents a 12.1% increase compared to the 2010 census.

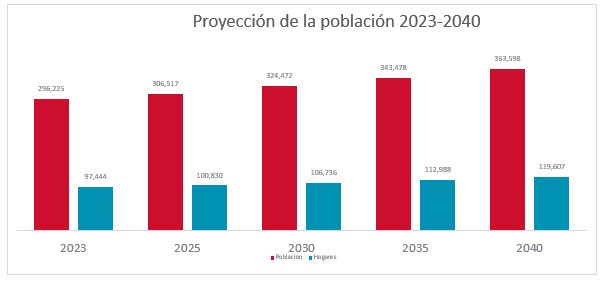

Data collected from INEGI’s population and housing census for the period 2010-2020 reveal a growth rate of 1.1% in the area of analysis within the municipality of Mexicali. Based on these data, CREA projects an increase in both the population and the number of households for the coming years, as illustrated in the attached graph.

Commerce

Mexicali stands out as a city with a diversified economy that encompasses not only the industrial sector, but also commerce and services.

One of the main commercial and service nerve centers in the metropolitan area of Mexicali is López Mateos Boulevard, which has established itself as an important corridor. According to data compiled by CREA, around 33,284 vehicles circulate daily on this avenue. Along this corridor, you will find a variety of shops and services, as well as important landmarks, such as the Autonomous University of Baja California Mexicali Campus, the Cosmo Industrial Park, the Fiesta Inn Mexicali, the State Theater, Liverpool, Bol Bol Mexicali, and Cinemex, among others.

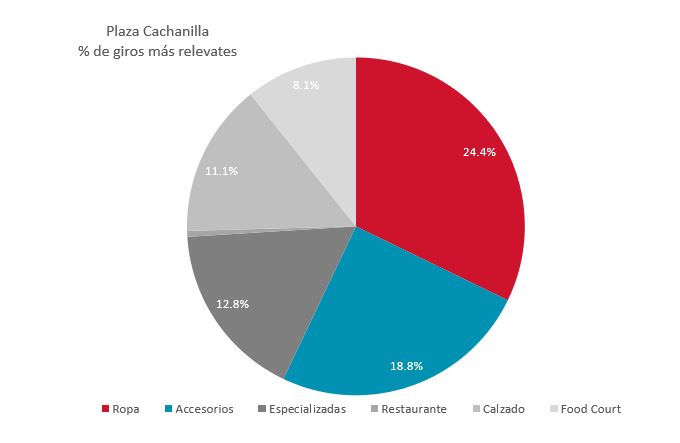

In this same corridor is one of the most emblematic shopping malls in the city: Plaza La Cachanilla, inaugurated in 1987.

This shopping center, in a closed Community Center format, has more than 44,000 square meters of gross leasable area and houses more than 230 stores, with a main focus on the clothing, accessories and specialties sectors.

At the end of the third quarter of 2023, the plaza reached 100% occupancy, with prominent anchor stores such as Ley, Coppel, Sears, Waldo’s, and DAX. In addition, the city is experiencing a boom in commercial projects such as Alameda del Valle, Albora Encuentro Urbano, CW Tower, and MAC Hospital, among others.

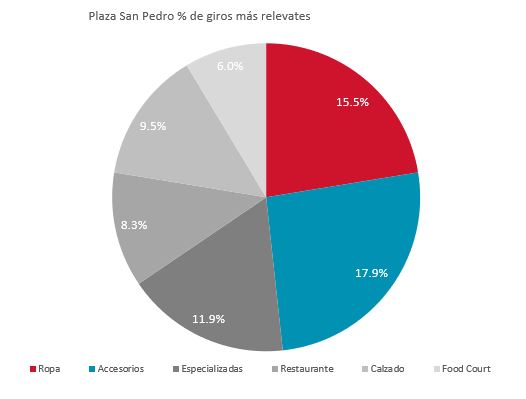

On the other hand, St. Peter’s Square, another significant shopping mall, was opened in 2006 and underwent a refurbishment in 2018.

This shopping center is located at the intersection of Calzada Cetys and Manuel Gómez Morín avenues, where around 45,253 vehicles circulate daily, 26% higher than the comparative traffic on López Mateos Boulevard in front of Plaza La Cachanilla.

St. Peter’s Square, also in a closed Community Center format, responds to the current needs of an expanding metropolis.

With more than 23,000 square meters of gross leasable area and 150 stores, the plaza achieved 100% occupancy at the end of the third quarter of 2023. Its anchor stores include Cinépolis, Cinépolis VIP, Walmart, and Office Depot, among others.

Tourism & Lodging

Tourism is another fundamental economic pillar for the city of Mexicali. At the end of 2022, the municipality had a total hotel offer of 96 hotels and 6,162 available rooms, representing 27.54% of the state offer. By August 2023, average hotel occupancy in Mexicali reached an impressive 66.7%, exceeding 2022 records by 2.5 percentage points and 2021 by 13.4 percentage points.

Data collected by Datatur reveal that, as of August 2023, 50.6% of tourists staying in Mexicali are national, while 16.1% come from other countries. The United States and Australia stand out as the main home nations of foreign visitors to Mexicali, as shown in the graph:

The Ministry of Tourism has registered a total of 676,494 rooms in Mexicali as of August 2023. Of these, 16% correspond to five-star hotels, 33% to four-star hotels, 32% to three-star hotels and 2.4% to two-star hotels. In addition, an average annual stay of 1.4 days is observed for the period from 2018 to 2023.

In terms of alternative accommodation, for 2020 there are a total of 501 units available on platforms such as Airbnb and Vrbo, which represents 7.2% of the accommodation supply in the city. 13

Alternative Accommodation Options

In 2020, there were 501 units available on platforms such as Airbnb and Vrbo, representing 7.2% of the city’s accommodation offer.

As far as air transport is concerned, Mexicali Airport has recovered its air arrival levels to pre-pandemic levels. Almost 100% of these arrivals are domestic flights. 2022 saw a remarkable 21.4% increase in domestic flight arrivals compared to 2021, and an impressive 73.9% compared to 2020. As of August 2023, 3,866 flight arrivals have been recorded. In addition, a project to expand the Mexicali Airport is in process, scheduled for presentation in 2025. Currently, the Ministry of Communications and Transport is preparing the investment plan for review and possible authorization.

If you are interested in investing in Mexicali, a city that is developing an interesting range of services and infrastructure to meet the demands of foreign trade and national economic activity, play it safe with a real estate market study carried out by CREA’s real estate consultants. Contact us and grow your investment.

Sources:

- ECONOMIC Overview of BAJA CALIFORNIA Directorate of Statistics July 2023 in https://www.bajacalifornia.gob.mx/Documentos/economia/Panorama-Economico-de-Baja-California-19.pdf

- Data Mexico, Baja California in https://www.economia.gob.mx/datamexico/es/profile/geo/baja-california-bc?redirect=true#:~:text=Origen%20Inversi%C3%B3n%20Extranjera%20Directa%20(FDI)&text=From%20January%20to%20June%20of,Bajos%20(US%2493.7M).

- Bank of Mexico (2023). Income from remittances, distribution by municipality – (CE166). https://www.banxico.org.mx/SieInternet/consultarDirectorioInternetAction.do?sector=1&accion=consultarCuadro&idCuadro=CE166&locale=es

- With this program, they will promote nearshoring in Mexicali in https://realestatemarket.com.mx/noticias/economia-y-politica/43316-con-este-programa-impulsaran-nearshoring-en-mexicali

- It’s the best time to invest in Baja California: Marina del Pilar, https://www.jornada.com.mx/notas/2023/06/09/estados/es-el-mejor-momento-para-invertir-en-baja-california-marina-del-pilar/

- Baja California Agrees with Businessmen for the Benefit of Nearshoring in https://www.lavozdelafrontera.com.mx/local/pacta-baja-california-con-empresarios-en-beneficio-del-nearshoring-10198201.html

- CREA 2023 – National Institute of Statistics and Geography (INEGI)2020

- CREA 2023 Estimates

- CREA 2023 Estimates Based on Mystery Shopper Interviews

- CREA 2023 estimates based on field visit

- CREA Shopping Centers Report 2023

- Baja California https://www.datatur.sectur.gob.mx/ITxEF/ITxEF_BCN.aspx

- Market Overview: Mexicali https://app.airdna.co/data/mx/102165?tab=performance

- Mexicali airport expansion projected for 2025 https://www.lavozdelafrontera.com.mx/local/ampliacion-de-aeropuerto-de-mexicali-se-proyecta-para-2025-10654176.html